New Delhi, June 10:

The Central government on Monday received a dividend of ₹8,077 crore from the State Bank of India (SBI) for the financial year 2023-24, marking a significant contribution to the exchequer’s non-tax revenue and reinforcing its fiscal stability.

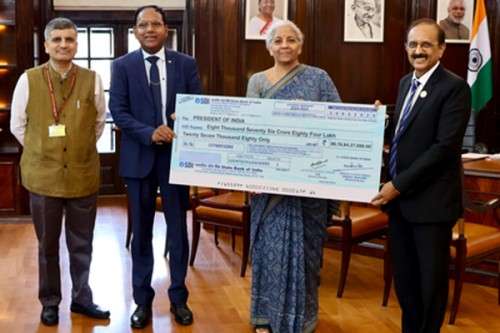

The dividend cheque was handed over by SBI Chairman Dinesh Kumar Khara to Union Finance Minister Nirmala Sitharaman in the national capital. This payout reflects SBI’s strong financial performance in the previous fiscal year and underscores the role of public sector banks in supporting the government’s economic objectives.

SBI, the country’s largest lender, reported a record net profit of ₹61,077 crore in FY24, driven by robust growth in net interest income, improved asset quality, and operational efficiencies. The bank declared a final dividend of ₹13.70 per equity share, with the government — holding a 57.5% stake in SBI — receiving a major portion of the disbursed amount.

“The dividend from SBI comes at a time when the Centre is focusing on maintaining fiscal prudence while sustaining capital expenditure and welfare programmes,” a senior Finance Ministry official said. The Centre has set a fiscal deficit target of 5.1% of GDP for FY25, with dividend receipts from public sector undertakings (PSUs) playing a critical role in achieving this goal.

According to analysts, such high-value dividends from profitable PSUs like SBI help bridge fiscal gaps without increasing the government’s borrowing burden. They also signal sound financial management and reinforce investor confidence in public sector enterprises.

This development follows the government’s interim Budget announcement, which projected non-tax revenue, including dividends and profits from PSUs, to exceed ₹1.04 lakh crore in FY24. The Finance Ministry is expecting similar or higher contributions in FY25, especially from major institutions like SBI, LIC, ONGC, and Coal India.

The ₹8,077 crore payout will support various public spending programmes, including infrastructure development, rural employment schemes, and social sector subsidies. It is also expected to provide some cushion ahead of the upcoming Union Budget, likely to be presented in July 2025.

SBI’s performance and dividend payout come at a time when the government is gearing up for more strategic disinvestments and reforms in the banking sector to enhance efficiency and profitability.