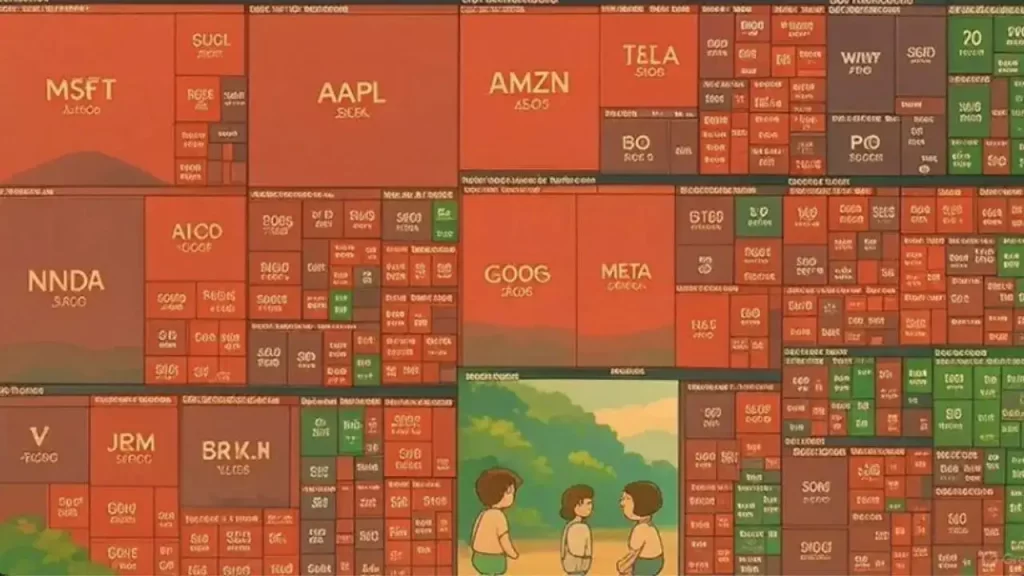

In a bizarre blend of panic and punchlines, global stock markets witnessed a dramatic crash on Monday, prompting the birth of a viral internet phenomenon now dubbed “Orange Monday.” The term, a cheeky nod to former U.S. President Donald Trump’s role in triggering market tremors with his surprise tariff announcement, has sent meme-makers into overdrive.

On May 6, Trump declared a sweeping reintroduction of tariffs on Chinese and Mexican imports during a campaign rally in Florida. The announcement sent shockwaves through the financial world, leading to a record one-day drop in major global indices. Wall Street’s Dow Jones plunged by 1,800 points, while India’s Sensex saw a sharp 950-point drop at market close.

Amidst the financial bloodbath, the internet did what it does best—turn crisis into content.

From Red to Orange: A Market Crashes, A Meme Rises

Traditionally, a market nosedive is referred to as a “Red Monday,” symbolizing losses. But with Trump’s signature tan complexion becoming a satirical centerpiece, social media rebranded the day as “Orange Monday.” The phrase quickly became a trending hashtag on X (formerly Twitter), Instagram, and Reddit.

One widely shared meme features Trump in a stock ticker, with the words: “Stocks going down faster than my approval ratings in 2020.” Another viral post joked, “Orange alert issued: Not for weather, but for your wallet.”

“Humor helps people process anxiety,” said digital culture expert Rashi Kapoor from the Indian Institute of Mass Communication. “In moments of uncertainty, memes offer a way to engage with news without feeling completely overwhelmed.”

Economic Fallout: Asia Feels the Heat

The ripple effects of the U.S. announcement were immediate across Asia. Japan’s Nikkei index fell 3.2%, Hong Kong’s Hang Seng slipped 2.8%, and India’s NSE Nifty dropped by 1.4%. Export-heavy sectors like technology and automobiles bore the brunt of investor sell-offs.

In India, the IT sector witnessed a 3% decline, with companies like Infosys and TCS losing considerable market value. “Global policy unpredictability is shaking investor confidence,” said market analyst Rajeev Mehta of Kotak Securities. “Volatility is the new normal until clarity emerges on U.S. trade intentions.”

Tech and Health Stocks Provide Slight Relief

Interestingly, not all sectors were in the red. Shares of pharmaceutical companies and select tech startups offering remote productivity solutions posted modest gains. Experts attribute this to the expectation that disrupted global trade could lead to a push for more localized, self-reliant production models.

India-based telehealth app MediCare+ saw a 2.5% bump in shares, and Chennai-based semiconductor firm Epsilon Circuits gained 1.8% following reports of rising demand for locally sourced components.

Celebrities Join the Meme Fest

Several Indian celebrities also joined the meme parade. Actor Riteish Deshmukh tweeted, “Even Sensex took a Monday off,” while comedian Vir Das posted a skit imitating a trader in panic shouting, “Buy memes, not stocks!”

Social media influencers capitalized on the trend too. Financial YouTuber Shweta Invests uploaded a parody video titled “How to Survive Orange Monday with Only Chai and Chill”, which racked up over 500,000 views in less than 24 hours.

What’s Next? Markets Brace for More Volatility

As global investors scramble for clarity, central banks and economic advisors across continents have issued statements urging calm. The Reserve Bank of India (RBI) noted that India’s fundamentals remain strong and short-term volatility should not shake long-term faith in the economy.

Still, analysts warn that unless the tariff situation de-escalates, more market turbulence is likely. Meanwhile, social media continues to serve as both a pressure valve and a creative outlet.

In the words of one viral meme: “When the world burns, we roast. Welcome to Orange Monday.”

Conclusion

While the global market crash has stirred legitimate concern across economies, “Orange Monday” stands as a testament to the internet’s resilience—and humor—during times of uncertainty. Investors may be counting losses, but meme-lovers are counting laughs, proving once again that when the chips are down, satire rises.